9 exempts a qualifying person from the payment of income tax in a basis period for a year of assessment in respect of the statutory income derived from a. B Tourism Tax Regulations 2017.

Pin On Packages Around The World

A Tourism Tax Act 2017.

. C Tourism Tax Digital Platform Service Provider Regulations 2021. This rate was fixed in September 2017 compared to. The estimated revenue to be raised from this tourism tax is RM65462 million assuming 60 occupancy rate of the 11 million room nights available in Malaysia.

MyTTx is an online submission and payment system for tourism tax TTx. Service chargeProperty tax. 6 on room rate.

Amendment No2 to Service Tax Policy No. The Income Tax Exemption No. KUALA LUMPUR Oct 30 The extension for tourism tax exemption until December 31 through the presentation of Budget 2022 in the Dewan Rakyat yesterday will help revive the tourism industry in the three Federal Territories.

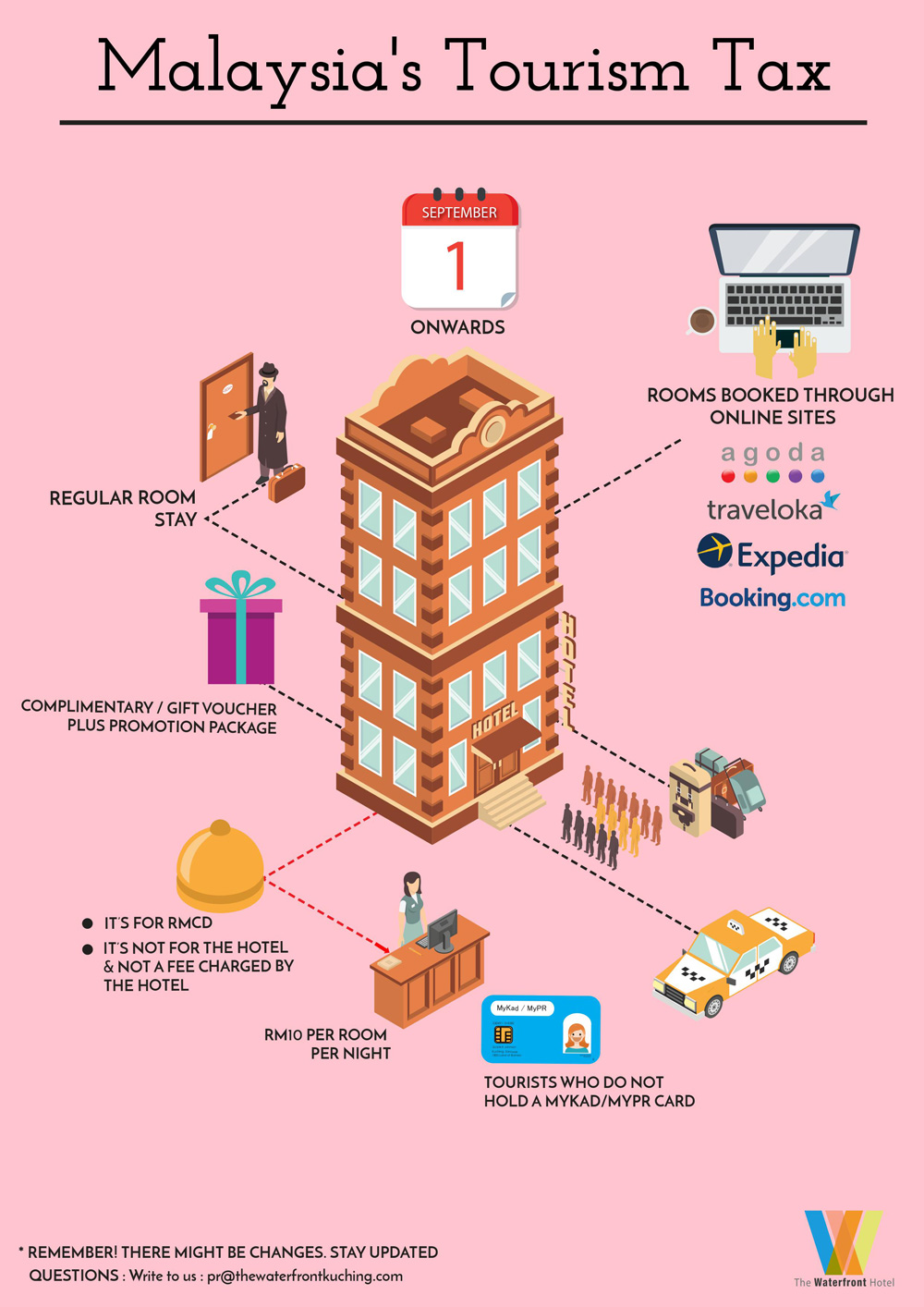

This tax will be imposed in addition to GST on both local and foreign tourists staying at any accommodation premises. To tax tourism or more accurately occupancy. For starters its good to remember that in Malaysia tourism taxes also known as TTx are only collected by owners of accommodation for the rental of these spaces and are usually labelled clearly in bills.

What is the Tourism Tax. 9 has effect from the year of assessment 2021 until the year of assessment 2022. The tax is intended to tax consumers who rent accommodation within Malaysia and it is for this reason these taxes have also been called occupancy taxes The concept of a TTx is not a new one and similar taxes are collected by various cities across the United States.

If you had booked a hotel or visited a tourist attraction in Malaysia during 2021 you could be eligible for an income tax relief of up to RM1000 on the expenses. The effective date is postponed to 1 January 2023 from 1 January 2022. Goods and services tax.

The tax to be implemented on August 1 will be in the form of an extra charge on hotel and hostel accommodation according to the announcement this week by the Royal Malaysian Customs Department. 9 Order 2021 PU A 3442021 EO. 9 was gazetted on 23 August 2021EO.

In relation to the tourism tax guidance ordersreleased 16 March 2021 and also effective 1 July 2021set forth the rate of the tourism tax per room per night. The latest data available from the MyTourismData portal of the Tourism Malaysia website stated that there are 4799 hotels and 304721 rooms in the country as of 2015. FAQs on tourism tax and bookings via online platforms.

The tax amounts to MYR10 per room and per night. As you may recall the special tourism tax relief that was announced under the Economic Stimulus Package 2020 originally for March to August 2020 had been extended up until. Malaysia Tourism Tax TRAVELLING to Malaysia is about to get more expensive thanks to a new tourist tax which comes into effect in August.

C Tourism Tax Rate of Tax Order 2017. Refund for bad debt 24. Read an August 2021 report prepared by the KPMG member firm in Malaysia.

The effective date for registration by the digital. Penang RM3 per room night 4- and 5-star hotels RM2 per room night for 3-star and below including all dorms budget hotels hostels and guesthouses. Recovery of tourism tax etc from persons leaving Malaysia 28.

Overview of Tourism Tax 2. Regarding the tourism tax for accommodation premise operatives the tax now applies innovative accommodations such as tent-type hotels caravans containers boathouses treehouses sleeping tubes tents cruises and such similar accommodations. The implementation of TTx is provided for under the following legislation.

And e Appointment of Date of Coming into Operation Order 2017. ROYAL MALAYSIAN CUSTOMS DEPARTMENT LEVEL 4 BLOCK A MENARA TULUS NO 22 PERSIARAN PERDANA PRECINCT 3 62100 PUTRAJAYA FEDERAL TERRITORY MALAYSIA https. The Royal Malaysian Customs Department on 20 January 2021 issued a set of frequently asked questions FAQs about the tourism tax and specifically addressing the expanded scope of the tourism tax regarding accommodations booked via an online platform.

The implementation of TTx is provided for under the following legislation. The Royal Malaysian Customs Department announced the postponement of implementation of the tourism tax that is to be imposed on accommodation premises booked through digital platform service providers. The responsibility for collecting the tax will be borne by the.

The Ministry of Finance and. BACKGROUND OF TOURISM TAX 2. An obligation to charge Malaysias tourism tax TTx and remit the tax to the tax authorities currently is scheduled to apply as from 1 January 2022 to digital platform service providers DPSPs that provide online booking services for accommodations in Malaysia regardless of whether the DPSP is a resident of Malaysia or a nonresident.

Federal Territories Minister Datuk Seri Shahidan Kassim said the exemption of entertainment duty in the entertainment. October 6 2021. Recovery of tourism tax etc.

If you are using older browser this system when viewed. B Tourism Tax Amendment Act 2021. Deduction from return of refunded tourism tax 25.

A Tourism Tax Act 2017. Read a March 2021 report prepared by the KPMG member firm in Malaysia. D Tourism Tax Exemption Order 2017.

Foreigners staying at paid lodgings in Malaysia will be charged a flat rate of RM10 US230 per night as tourism tax while Malaysians will now be exempted from it completely Tourism and Culture Minister Nazri Aziz said on Wednesday Jul 26. An exemption is provided for tourists who are Malaysian citizens or permanent residents of Malaysia. 10 on room rate.

It is available 24 hours daily and accessible anywhere. During the exemption period Tourism Tax should be recorded as exempt or NIL or RM000 in the invoice issued to foreign tourists. Refund of tourism tax etc overpaid or erroneously paid 23.

Power to collect tourism tax etc from persons owing money to operator 26. The system can be accessed through Internet Explorer Version 110 or above latest version Chrome and is best viewed at 1024 x 768 monitor resolution or higher. Online booking accommodation premises to a tourist relating to the implementation of Tourism Tax TTx.

The amount of Tourism Tax exempted must be stated in Column 7 of the TTx-03 Return ie. Payment by instalments 27. The Tourism Tax in Malaysia will apply to foreign tourists that stay in a paid accommodation starting 1 September 2017.

The TTx has also been set at a flat rate of RM10 per night per room rented. Heritage taxsurchargelocal government fee varies from location to location. The implementation of Tourism Tax TTx.

The amount exempted for each night per room.

Operations Excellence For Health Tourism Center For Health Tourism Strategy Medical Tourism Medical Tourism Infographic Tourism

Simply Big Travel With Our Package 3 Star Hotel Stay 10 Years Membership Plan Travel 7 Days Per Year For 2 Adults 2 Minor For Mor Trip Hotel 10 Years

Mwst Ruckerstattung In Singapur Leitfaden Fur Touristen Visit Singapore Official Site De Singapur Leitfaden

Mexico Tourist Visa Requirements And Application Procedure Visa Traveler

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Eastwood Valley Golf Country Club Rooms And Suites

Malaysian Tourism Tax The Waterfront Hotel

Malaysia Package Stay The Night Tourism Trip

Thailand Medical Tourism 2018 Review The Thaiger Medical Tourism Tourism Malaysia Tourism

Edinburgh Tourist Tax Backed By Council Tourist Iseo Edinburgh

Pin On Backpacking Malaysia Singapore

Official Niagara Tourism Information Vacation Road Trips Vacation Inspiration Fall Travel

Sst Malaysia Malaysia Tax Services Tax Payment

Pdf The Effect Of Tourism Taxation On Tourists Budget Allocation

Get In Touch 3 Days 2 Nights With Genting Dream Cruise The Asia S Luxury Cruise Valid Now 22 Oct 18 Website Www Dream Cruise Luxury Cruise Cruise Port

Singapore Malaysia And Thailand Tour Packages At Unbeatable Price Thailand Tours Singapore Tour Package Singapore Tour

- list of malaysian legends

- tafsir mimpi arti mimpi potong rambut

- bintik merah pada kulit tetapi tidak gatal

- engtex properties sdn bhd

- air di atas daun keladi

- percutian ke pulau redang

- harga rim besi kereta

- my hotel @ kl sentral

- ujian test jpj kereta

- cara buang selaput putih pada mata

- hvid skjorte til bryllup

- sandal bata tun m

- ministry of foreign affairs kuching

- how many states are there in malaysia?

- surat permohonan statement bank

- kedai perabot murah ampang

- harga kotak hitam elektrik

- rhb kad kredit contact number

- baterias infladas

- undefined